Guest Contribution: “The Federal Funds Rate: FOMC Projections, Policy Rules, and Futures Markets”

Today, we present a guest post written by David Papell and Ruxandra Prodan-Boul, Professor of Economics at the University of Houston and Economics Lecturer at Stanford University.

The Federal Open Market Committee (FOMC) maintained the target range for the federal funds rate (FFR) at 5.25 – 5.5 percent in its January 2024 meeting. With falling inflation, the December 2023 Summary of Economic Projections (SEP) projected a range for the FFR between 4.5 and 4.75 percent by the end of 2024. At the press conference following the January 2024 meeting, Fed Chair Jerome Powell said that the FOMC was not likely to cut rates in March. In contrast, futures markets summarized by the CME FedWatch Tool on the day following the meeting predicted a range for the FFR between 3.75 – 4.00 percent by the end of 2024.

There is widespread agreement that the Fed fell “behind the curve” by not raising rates when inflation rose in 2021, forcing it to play “catch-up” in 2022. “Behind the curve,” however, is meaningless without a measure of “on the curve.” In the latest version of our paper, “Policy Rules and Forward Guidance Following the Covid-19 Recession,” we use data from the SEP’s from September 2020 to December 2023 to compare policy rule prescriptions with actual and FOMC projections of the FFR. This provides a precise definition of “behind the curve” as the difference between the FFR prescribed by the policy rule and the actual or projected FFR. We analyze four policy rules that are relevant for the future path of the FFR in the post:

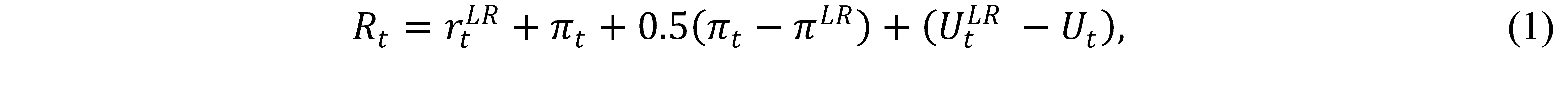

The Taylor (1993) rule with an unemployment gap is as follows,

where Rt is the level of the short-term federal funds interest rate prescribed by the rule, πt is the inflation rate, πLR is the 2 percent target level of inflation, ULRt is the 4 percent rate of unemployment in the longer run, Ut is the current unemployment rate, and rLRt is the ½ percent neutral real interest rate from the current SEP.

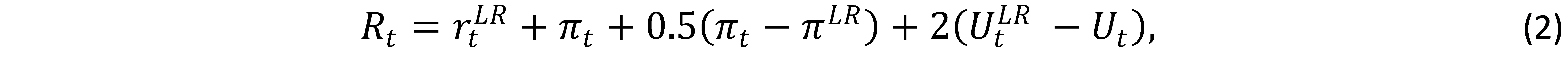

Yellen (2012) analyzed the balanced approach rule where the coefficient on the inflation gap is 0.5 but the coefficient on the unemployment gap is raised to 2.0.

The balanced approach rule received considerable attention following the Great Recession and became the standard policy rule used by the Fed.

These rules are non-inertial because the FFR fully adjusts whenever the target FFR changes. This is not in accord with FOMC practice to smooth rate increases when inflation rises. We specify inertial versions of the rules based on Clarida, Gali, and Gertler (1999),

where p is the degree of inertia and is the target level of the federal funds rate prescribed by Equations (1) and (2). We set p as in Bernanke, Kiley, and Roberts (2019). Rt-1 equals the rate prescribed by the rule if it is positive and zero if the prescribed rate is negative.

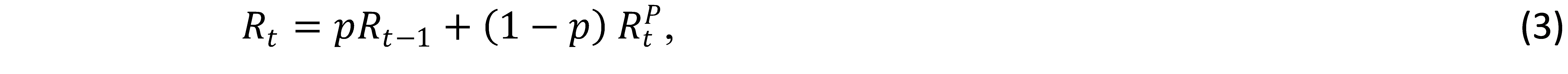

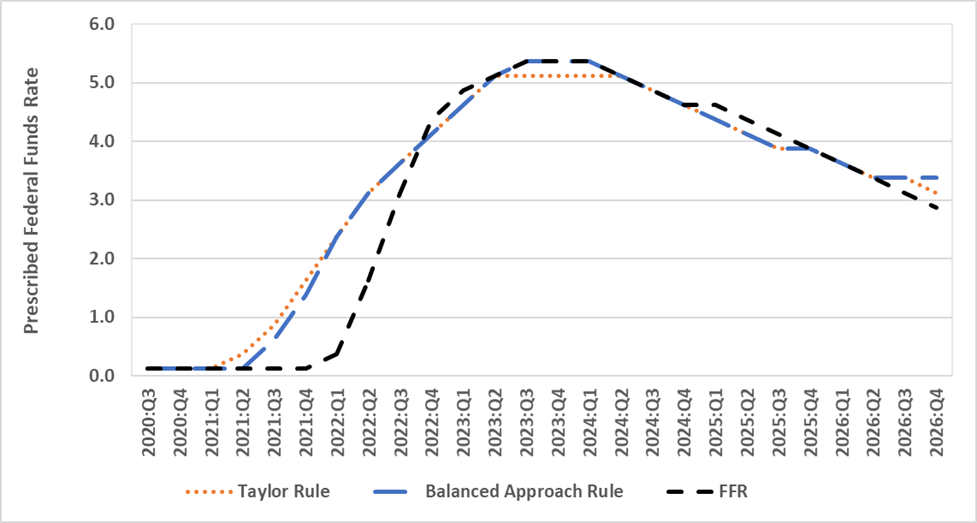

Figure 1 depicts the midpoint for the target range of the FFR for September 2020 to December 2023 and the projected FFR for March 2024 to December 2026 from the December 2023 SEP. Following the exit from the ELB to 0.375 in March 2022, the FFR rose to 5.375 in September 2023 and is projected to fall to 4.625 in December 2024, 3.625 in December 2025, and 2.875 in December 2026. Based on Jerome Powell’s answer to a question at the press conference following the January 2024 meeting that it is unlikely that the FOMC will cut the FFR in March, we assume that there will be 25 basis point rate cuts in June, September, and December 2024. Figure 1 also depicts policy rule prescriptions. Between September 2020 and September 2023, we use real-time inflation and unemployment data that was available at the time of the FOMC meetings. Between December 2023 and December 2026, we use inflation and unemployment projections from the September 2023 SEP. The differences in the prescribed FFR’s between the inertial and non-inertial rules are much larger than those between the Taylor and balanced approach rules.

Figure 1. The Federal Funds Rate and Policy Rule Prescriptions. Panel A. Non-Inertial Rules

Policy rule prescriptions are reported in Panel A for the non-inertial Taylor and balanced approach rules. They are not in accord with the FOMC’s practice of smoothing rate increases when inflation rises. The prescriptions for the two rules are identical at the ELB through March 2021. The FOMC fell behind the curve starting in June 2021 when the prescribed FFR increased from the ELB of 0.125 to 2.625 for the Taylor rule and to 0.375 for the balanced approach rule while the actual FFR stayed at the ELB. The policy rule prescriptions sharply increased through 2021 and peaked in March 2022 at 7.875 for the Taylor rule and 8.125 for the balanced approach rule when the FFR first rose above the ELB to 0.375. The gap also peaked in March 2022 at 750 basis points for the Taylor rule and 775 basis points for the balanced approach rule. The gap narrowed considerably between March 2022 and September 2023 as the FFR rose from 0.375 to 5.375 while the Taylor rule prescriptions fell to 6.125 and the balanced approach rule prescriptions fell to 6.625. Looking forward, the gap between the FFR projections and the policy rule prescriptions reverses in December 2023 and the FFR projections are above the policy rule prescriptions through December 2026.

Figure 1. The Federal Funds Rate and Policy Rule Prescriptions. Panel B. Inertial Rules

Panel B reports the results for the inertial Taylor and balanced approach rules. They are much more in accord with the FOMC’s practice of raising the FFR slowly when inflation rises. The prescriptions for the two rules are identical at the ELB through March 2021. The FOMC fell behind the curve starting in September 2021 when the prescribed FFR increased to 0.875 for the Taylor rule and 0.625 for the balanced approach rule while the actual FFR stayed at the ELB. The gap between the policy rule prescriptions and the FFR peaked in March 2022 at 200 basis points when the prescribed FFR was 2.325 for both rules while the FFR first rose above the ELB to 0.375.

The inertial rules prescribe a much smoother path of rate increases from September 2021 through September 2023 than that adopted by the FOMC. If the Fed had followed the inertial Taylor or balanced approach rule instead of the FOMC’s forward guidance, it could have avoided the pattern of falling behind the curve, pivot, and getting back on track that characterized Fed policy during 2021 and 2022. Looking forward, the FFR projections from the December 2023 SEP are very close to the policy rule prescriptions through December 2026. The current and projected FFR is in accord with prescriptions from inertial policy rules.

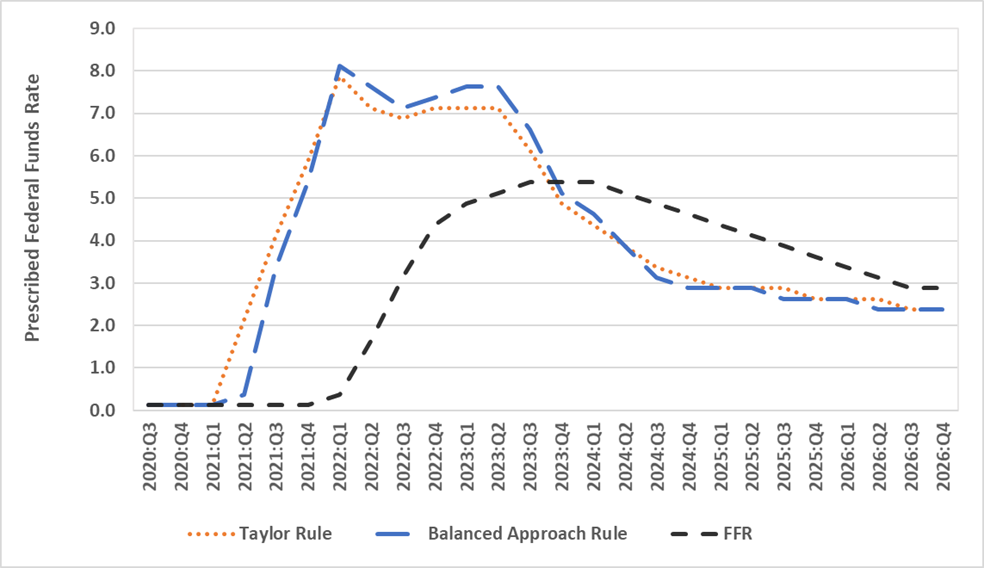

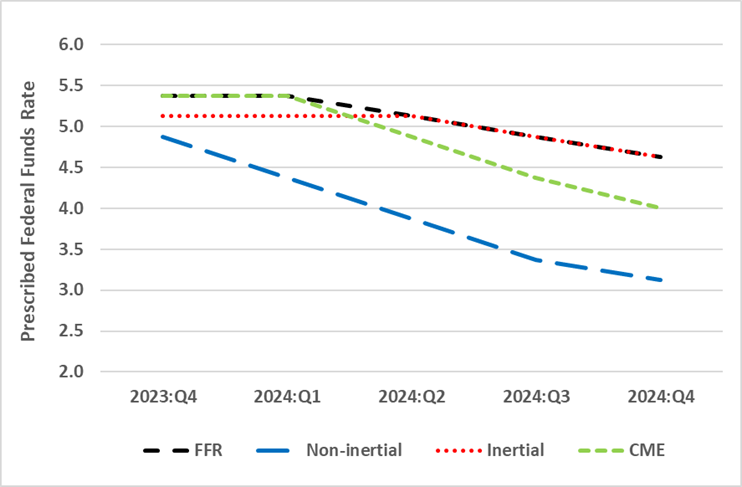

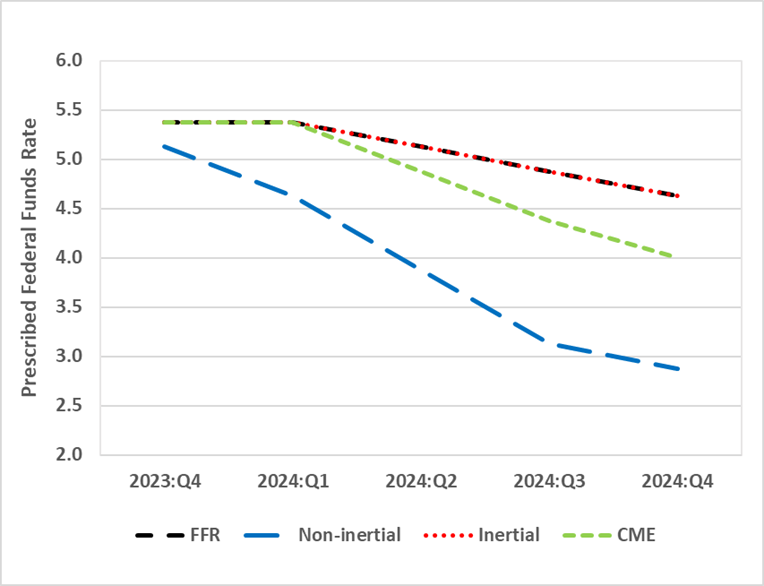

It has been widely reported that market participants have been predicting a steeper downward path for the FFR than the SEP. Figure 2 depicts the median predictions from futures markets described in the CME FedWatch Tool on February 1, 2024, the day following the January 2024 FOMC Meeting, through the end of the prediction horizon in December 2024. The FFR is predicted to fall from 5.375 in March 2024 to 4.875 in June 2024, 4.375 in September 2024, and 3.875 in December 2024. The futures market predictions are equal to the FFR projections from the December 2023 SEP for March 2024 and fall below the projected FFR from June 2024 through December 2024.

Figure 2: The Federal Funds Rate, CME FedWatch Tool, and Policy Rule Prescriptions. Panel A. Taylor Rules

Figure 2: The Federal Funds Rate, CME FedWatch Tool, and Policy Rule Prescriptions. Panel B. Balanced Approach Rules

We add to this discussion by including prescriptions from policy rules. For both the Taylor and balanced approach rules, the futures market predictions equal the FFR and are below the prescriptions from the inertial policy rules for June 2024 through December 2024. In contrast, the futures market predictions are above the prescriptions from both non-inertial policy rules from December 2023 through December 2024. Comparison between futures market predictions and policy rule prescriptions depends on the choice between inertial and non-inertial rules but not on the choice between Taylor and balanced approach rules.

<

This post written by David Papell and Ruxandra Prodan-Boul.

Source link